Blogs

One of the larger great things about this type of house is that you experienced elements of the markets and also the business can be better to determine, instead of commercial functions, such a mall. But investing a property is normally a long-label game, and people hoping to get in it is always to think with this mindset after they go into it. And even when the rates try large now, this may only be a great time to accumulate bucks for a down payment when you are waiting for cost to help you decrease in 2025. Do not let one facts steer your from investing in genuine estate, but not.

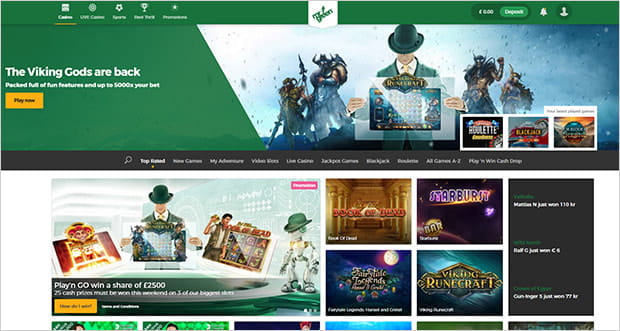

Lucky leprechaun video pokie | Anti-Money Laundering Regulations to own Residential Home Transfer

- The brand new apartment complex create generate to $3 hundred,one hundred thousand inside terrible yearly lease with expected expenditures from 29%, resulting in $210,one hundred thousand online functioning earnings (NOI).

- Approximately 23% incorrectly thought a home using allows them to end their full-date jobs, while you are 24% be sorry for being to the-need clients and others twenty four/7, without having any correct time away.

- Prices rose to get rid of 2024, and been 2025 swinging large, but i have as the went a bit lower.

- The final Code mainly adopts the newest 2024 NPRM having small clarifications.

- Such, should your property is inside a safe city, a lower Value for your dollar may be acceptable.

- From the a couple of-thirds create believe features having squatters (67%), basis points (65%), or a top threat of disasters, such as floods, wildfires, otherwise hurricanes (62%).

The brand new NAR’s mls, otherwise Multiple listing service, used in the a neighborhood level round the parts on the U.S., facilitated the brand new settlement rates for both an excellent client’s and you can seller’s agents. Speak about Business person’s A property resources right here for lots more guidance and you may information about the actual estate company. Do your research, create an idea, and start the right path to your making money in the home. There are numerous misconceptions when it comes to the genuine house community. When you are home will be a good hustle at the beginning of your career, it does be a lucrative, self-running business when you are getting the concept from it. John and Julie Wakefield, a husband-and-spouse turning people just who’ve complete numerous flips, say some thing similar.

As to why Purchase Home?

To participate difficult-currency lending, you’ll need some money trailing you. Speaking of finance which might be have a tendency to in the higher rates while the they’re also to have really temporary symptoms. When you yourself have everything you end up being is actually a “sure issue” however, lack the funding, this can be your best bet. Lenders face extreme exposure which have tough currency money by potential load which can influence if your debtor defaults, that is why such finance typically feature highest attention prices. Individuals has a preliminary payment name and you can risk shedding their property whenever they standard.

Which are the common kind of real estate investment characteristics?

You could potentially produce a property, book home and lucky leprechaun video pokie business room or promote features. To have a go in the earning profits as a result of a home spending, you need to and acquire expertise in the company just before plunge for the deep prevent of the pool. By opening this site and you can any users thereof, your agree to become bound by all of our terms of service and you can privacy.

The main focus to the well worth and you may security brings a lot of independency which allows to possess private money loan providers to help you accept and you may money fund right away. The new quick approvals and you may funding is the primary reason a house buyers utilize the features away from individual money lenders for their residential home money. They prefer to do business with a debtor who gathers a normal paycheck from a company. Nevertheless they want to see the debtor have a constant a career records possesses held it’s place in their latest reputation to own from the minimum couple of years. Full-go out home buyers are mind-functioning and you can wear’t provides a normal paychecks.

Could it be really worth getting into a house paying?

Next, we may, periodically, update otherwise modify this service membership and you may/otherwise associated programs or issue, that may provide all for example previous versions obsolete. Thus, i put aside the legal right to terminate so it Contract regarding all the such past models of your Services, and/otherwise relevant programs and you may matter and restriction access to only the Service’s new posts and you can status. Your authorize us to post otherwise offer by electronic interaction any notice, interaction, amendment or replacement for for the Contract, or revelation expected to be provided orally or perhaps in writing to you. Your commit to get any digital interaction provided to both you and will not attempt to end finding such communications. You’re considered to possess gotten people electronic communications offered to you if they are given to your. Unaffiliated articles and links to other websites can be provided with businesses on the internet site through which the service is out there.

This is caused by difficulties with basic possibilities for example plumbing system, electricity or architectural difficulties. Uninhabitable qualities will not qualify for a conventional financial home loan, but the a home individual could obtain an excellent difficult money loan. Because the investor acquires the real home that have a challenging money mortgage they’ll be able to treatment the house, allow it to be habitable after which re-finance in order to a normal financial or promote the house to have a profit. Like to focus on Northern Coastline Monetary, among the best difficult currency lenders inside the California. While the a direct hard loan provider, North Coast Financial have multiple types of funding to fund your own tough money mortgage request. Personal money offer accommodate shorter and more versatile financing possibilities than just old-fashioned a style of financing including banks, borrowing unions and other institutional loan providers.

Long-term rental property

You’ll need some mental intelligence to help you discern what consumers searching for to possess and how to market to him or her when acting as the brand new wholesaler. With more than several years of expertise composing regarding the housing marketplace place, Robin Rothstein demystifies mortgage and you may loan principles, helping basic-time homebuyers and you will people generate advised decisions because they browse the new financial opportunities. The girl works could have been wrote otherwise syndicated to your Forbes Advisor, SoFi, MSN and Nasdaq, certainly other mass media stores. Mortgage Brands OfferedKiavi also provides enhance and you can flip finance, DSCR leasing finance, rental portfolio financing and you can connection fund.

Recent Comments